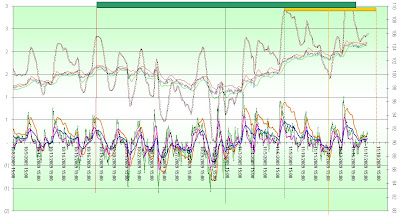

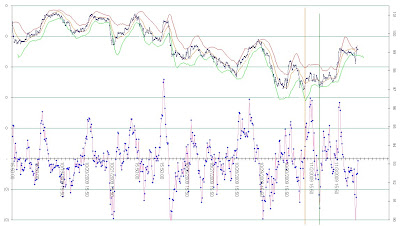

In the top chart of the Basic Volume Indicator, the red line shows the incorrect placement of the Center Post of the green T in the middle chart. The incorrect T was placed at 14:20 on November 2, 2009. The next green line in the upper chart of the Basic Volume Indicator shows the correct placement of the Center Post at 11:30 yesterday morning, November 3, 2009. This latest T began at 10:10 on Monday November 2, 2009 and ended this afternoon at 13:00 November 4, 2009.

When I constructed the green T, I did not place the center post at 14:20 on November 2, 2009. I made a mistake in the placement and therefore the entire green T is hogwash. The oversold reading of the basic volume oscillator gives us a good reading on the last center post, however, the oversold reading of the basic oscillator tends to be too early. The Center T Oscillator broke down here and was of no help. I drew a downtrend line over the cash build up phase in order to accurately determine the center post. Since this last T is expired and we are definitely in a chah build up period and the Daily longer term T has expired, I shorted BGU at 48.83 on the close and bought BGZ at 21.51 on the close.

I have to think seriously about the jobs report due out on Friday and will not hold any position into the report. I have had some trouble uploading my charts, otherwise I would have publishes my blog before the Federal Reserve announcement. I think I have solved my problem and hope to be more timely with my postings.

It is very ominous how this market cannot hold on to a rally. Whenever there is a merger or a buyout like yesterday the market usually soars because the supply of stock has been reduced and there is an injection of cash into the capital markets which naturally drives the price of stocks higher. Yesterdays market did not act well in the light of the buy out of BNI by Berkshire and the merger of Stanley and Black and Decker. That is a lot of stock taken out of this market and no significant rally in stock prices to reflect the fundamentals. I wonder what the jobs report will reflect on Friday AM.